With the Pro Plan, automatically import, merge, and categorize your bank transactions. It’s always available, and it’s backed up for extra peace of mind. Our servers are protected physically and electronically.

Contents

Data Used to Track You

- Wave is PCI Level-1 certified for handling credit card and bank account information.

- With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer.

- This can help you save time and make financial decisions quickly.

- Subscriptions will auto-renew until you choose to cancel.

- When inputting information the character count for it is super slow/delayed to where it forces me to stay on a certain page until it registers that information has been inputted.

Be your own accountant, thanks to Wave’s automated features, low cost, and simple interface. This app is super helpful, the main issue I have while using it is the lag. When inputting information the character count for it is super slow/delayed to where it forces me to stay on a certain page until it registers that information has been inputted. After inputting information and trying to click done at the bottom it will not register unless I swipe the keyboard away.

Plans to makeyour plans happen.

Sign up for Wave and send your first invoice right away—it only takes a few minutes! With the Pro Plan you can also set up recurring payments, auto-reminders, https://www.accountingcoaching.online/ and deposit requests to make sure you always get paid on time. Yes, switching from other accounting apps or products to Wave is easy!

Button up your business with professional invoices.

Get paid in as fast as 1-2 business days1, enhance your brand, and look more professional when you enable payments. Customers can click a Pay Now button on invoices and pay instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay. You can accept credit cards and bank payments for as little as 1%2 per transaction. Wave’s mobile receipts feature lets you instantly input expenses into Wave. With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer.

You’ll need to answer a few questions about your business and provide us with a little more information about yourself in order to get approved to accept online payments. In addition to its accounting software, Wave offers paid services, including Wave Payments, Wave Payroll and Wave Advisors for bookkeeping support and accounting coaching. Set up recurring invoices and automatic credit card payments for your repeat customers https://www.accountingcoaching.online/2-4-actual-vs-applied-factory-overhead/ and stop chasing payments. Create beautiful invoices, accept online payments, and make accounting easy—all in one place. Wave Accounting is ideal for micro businesses with fewer than 10 employees, contractors, freelancers and other service-based businesses on a budget. The financial management software is user-friendly and equipped with all the basics, including income and expense tracking, invoicing and reporting.

Pocket- and small business-friendly perks

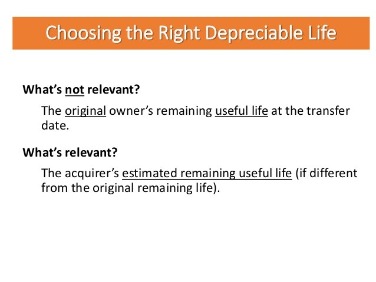

Includes tools that help automate the reconciliation process and auto-categorizes transactions for you in the Pro plan, but you can’t set up your own bank rules; no global search function. Christine Aebischer is an assistant assigning editor on the small-business team at NerdWallet who has covered business and personal finance for nearly a decade. Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance. She has also held editing roles at LearnVest, a personal finance startup, and its parent company, Northwestern Mutual.

It’s time for Wave to evolve and adapt to meet the needs of small business owners once again. If you’re wondering what a chart of accounts is, and if your business needs it, you’ve come to the right place. QuickBooks Online’s detailed reporting and transaction tracking is ideal for growing businesses. Only what is gross pay and how is it calculated integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

When you reconcile your books, you’ll navigate to the “Reconciliation” tab within the Accounting menu. If you need to manually edit, add or remove any transactions, you can do so on the Reconciliation or Transactions pages. Next, you can add sales tax (if necessary), create customer profiles and customize your invoice templates. You can sign up for Wave quickly and easily online. After providing a few basic details about your business — name, type, currency you use, address — you’ll have instant access to your account. Can manage multiple businesses for free under one account; lacks project tracking tools, industry-specific reports and transaction tracking tags.

Avoid any tax season nightmares with more accurate books, records, and reports. Xero lets you add unlimited users in all plan tiers and, similar to QuickBooks Online, can grow alongside your business. Zoho Books offers a robust free plan, along with a range of paid plans that feature workflow automation. FreshBooks is an affordable option for freelancers and small service-based businesses that operate mostly on the go. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the app marketplace. There are also add-on Intuit services like QuickBooks Payroll or QuickBooks Time.

The most basic plan, Simple Start, costs $30 per month, and the top-tier Advanced plan costs $200 per month, which is a sizable investment if you’re running a business on a tight budget. Our partners cannot pay us to guarantee favorable reviews of their products or services. Wave uses real, double-entry accounting software.

However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money. Know when an invoice is viewed, becomes due, or gets paid, so you can stay on top of your cash flow better than ever. Easily monitor and keep track of what’s going on in your business with the intuitive dashboard. The quick summary allows you to stay in control of your business finances, including a task list of outstanding items.